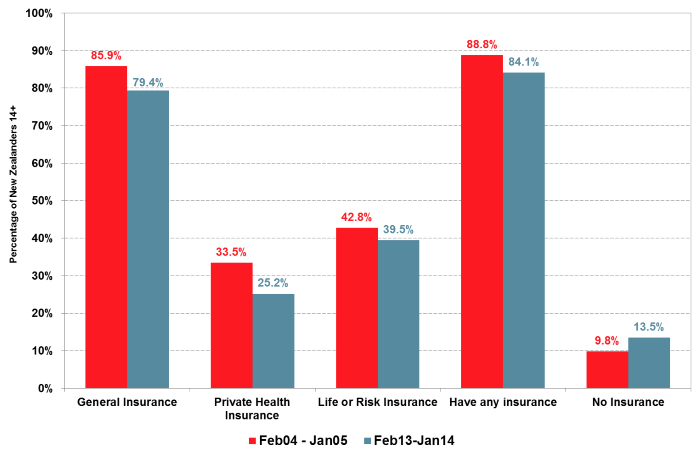

I wrote recently about a new approach Asteron was taking to income protection.

In the right client situation quite appropriate, in others it would potentially be a disaster. As the options in insurance advice expand and hybrid or niche products develop, the need to have an adviser involved is even more apparent. One that really understands the application of insurance benefits to your risks.