Roy Morgan Research has published updated information on insurance coverage in New Zealand and it is not a particularly pretty picture.

What does it really look like out there in New Zealand?

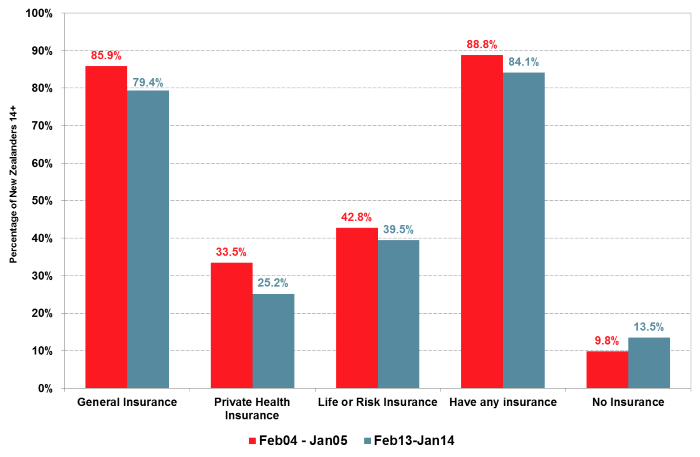

Almost 1 in 7 Kiwi’s do not have any insurance cover at all. I don’t know about you, but 1 in 7 people I know are not financially independent enough not to need insurance cover at some level. This suggests Kiwi’s are taking the risk that ‘she’ll be right’. This may be knowingly but most likely unknowingly.

With workplace deaths, suicide and other things that Kiwi's top the charts in the early death stakes, we should be more aware and better covered.

In ten years about 165,000 people (adults and children) no longer have any insurance coverage at some level. This is an increase from 9.8% to 13.5% of the population with no coverage, this includes basic covers like car insurance.

On the more specific areas of insurance coverage.

With general insurance such as home, vehicle or other property; as of January this year, 79.4% have cover

With life or risk insurance 39.5% of people have cover, or about 60% of the population don't.

Private health insurance has suffered biggest decline in cover from 1 in 3 Kiwi’s covered in 2005 to just 1 in 4 at the start of 2014. This is in the face of reduced services and longer wait for the public system for many people.

With disability insurance, less than 1 in 5 Kiwi’s have cover to replace their income if they are disabled, with accidents making up about 40% of all disabilities, there are a lot of people relying on their savings to get them through a medical disability.

What does this all mean for you?

On average medical insurance will get to you 100 days sooner than the public system for your treatment, but it will cost you more than it did ten years ago. The number of people out there who have had medical insurance who now do not equates to about 159,000. These are additional people putting more pressure on the public system that was already stretched, which will make the wait longer for everyone.

The largest group that had cover that now do not, is in the 25 to 34 year old age group. This group is the group typically having children. Less coverage here will put increased pressure on children’s public medical services, as these children will not be looked after in the private system. Services around ear, nose and throat conditions, which are the more common children’s claims, will be the one to see the most demand.

Our people over 65 are finding it tougher to maintain their medical insurance cover due to cost, what most do not realise there are ways to save premium without completely dropping coverage. Having things like surgical only rather than specialists, tests, GP’s and prescriptions can save considerable premium. Excess options can make maintaining cover easier too.

Where do people get their medical cover?

Southern Cross continues to be our largest insurer with 48.4% of the market. We have a healthy medical insurance market with 10 medical insurers competing for your cover. This gives us a large range to tailor the sort of coverage you need to fit your budget.

Around 4 in 10 of those with private health insurance obtained it through their employer, and another 4 in 10 through an insurance adviser with the rest coming from child to adult transfers.

Get in touch with us, we are insurance advisers and can assist with arranging the right cover with the right provider for you.

The information is only intended to be of a general nature and should not be relied upon in any part without obtaining full details of the products and services by contacting Willowgrove Consulting Limited. All product and service details, terms, conditions and other information are subject to change at anytime without notice. Terms, conditions and fees apply to the various products and services and are available on request. A disclosure document will be provided to you on request free of charge.

Terms & Conditions

Subscribe

My comments