According to the stats, a significant portion of KiwiSaver members are not in the most effective fund to maximise their retirement returns, and many are unsure where their KiwiSaver account is invested.

For some, it is a choice to be there, for some good reasons. Others do so because they did not receive the advice they needed when they joined and have not reviewed it.

There are four key areas that KiwiSaver members don't understand well: Fund Type, PIR rate (tax rate), Member Tax Credits, and Fees.

- A common misunderstanding with fees is focusing on the fees charged rather than the returns after fees.

- A fund charging a 1% fee and returning 8% after fees is more desirable than a fund charging 0.5% and returning 5% after fees. The growth of your wealth is the focus of your KiwiSaver; the fees are a component, but they are not a direct measure of performance.

- And clearly if the fee is say 2% and the returns are 4% after fees, you also need to have a closer look at what's going on.

If you want to talk to Generate about your KiwiSaver, please get in touch.

Why do we care?

As your risk adviser insuring you while you are working to maintain your lifestyle in a disability is important and a key issue. Protecting your contributions to your retirement savings is also a consideration when we give insurance advice. Being on a disability claim for 20 years will impact your ability to save for retirement.

We can protect you and a level of your contributions to KiwiSaver through to age 65 or 70. However, if your approach to retirement savings isn't managed well you may still have a problem. We might get you to retirement financially with income protection insurance and find there isn't sufficient retirement income to get you much further.

We continue to see people with KiwiSaver products that are not working as well as they should from the simple questions we ask.

There appears to be a cost barrier to accessing even simple KiwiSaver advice, we feel this is a massive hole in the creation of wealth for New Zealanders.

We feel that helping New Zealand workers and KiwiSaver members understand the scheme and how to best use it is of significant value.

Ultimately, we want you to make the best decisions for yourself. We do this by increasing your knowledge through education.

While we will give you personalised advice on your Life and health Insurance, we are not specialist investment advisers, and we are limited in what we can do with your KiwiSaver. We are effectively limited to explaining the scheme and how it works so you can make better decisions about what you need to ask for from your provider or seek further advice.

If you need personalised investment advice, we can introduce you to a qualified Investment Financial Adviser who can provide it.

We don't provide advice on KiwiSaver, but we do maintain a professional relationship with Generate KiwiSaver to assist our clients who need KiwiSaver assistance and advice. We get paid by Generate KiwiSaver when people we introduce move to them.

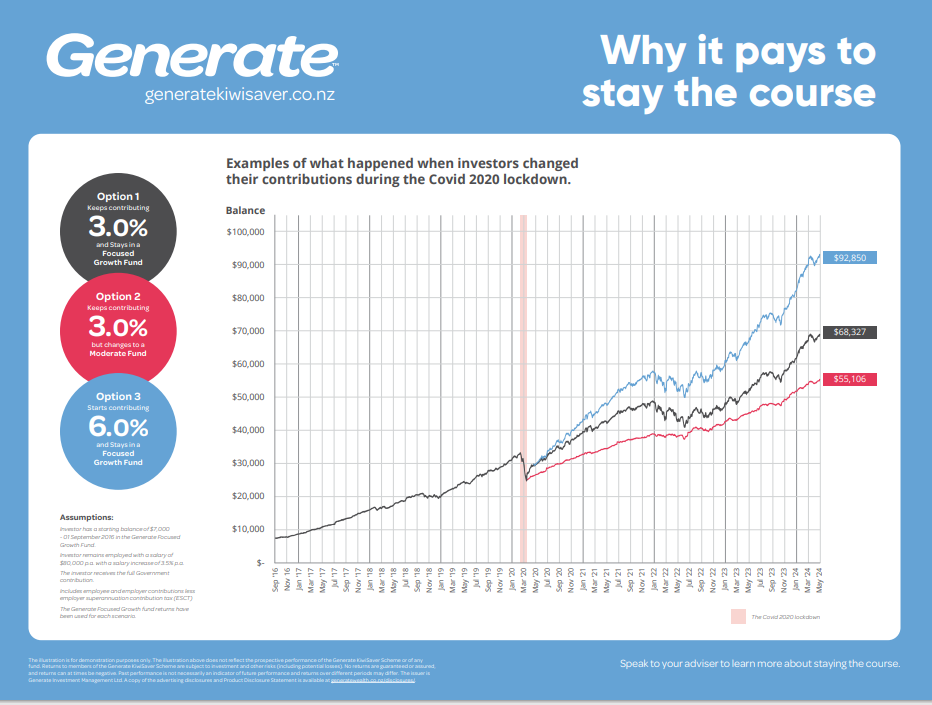

Generate has published the following graphic to help people understand market volatility. If you have concerns about your KiwiSaver and what you are experiencing, please get in touch, and we will connect you with an investment adviser who can help.