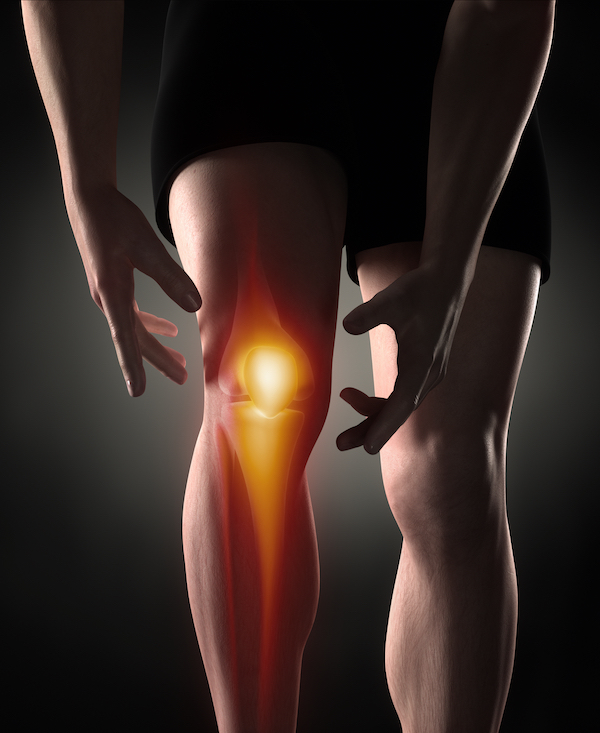

Have you had an injury or medical event, and you have found you haven't been treated as quickly as you expected, with the result you are now living with some level of permanent impairment?

Over the years, this situation has arisen regularly, prompting some interesting responses from our medical and health systems.