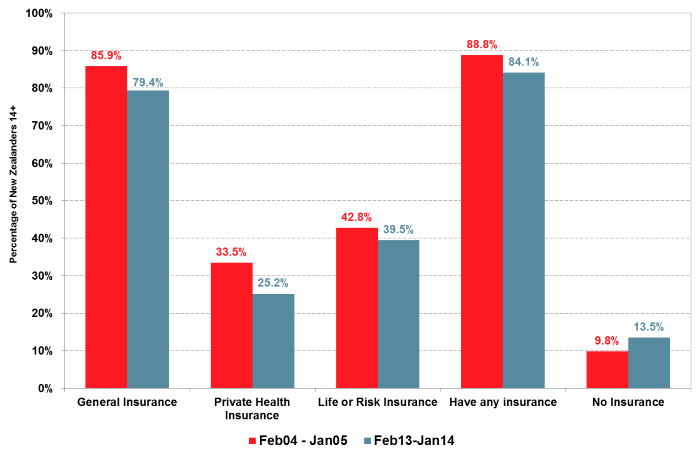

A really good question. Let's tackle over insurance first

With over insurance, in its simplest form, if the risk is not realised, you've paid more for the transfer of risk than you had too. What I'm meaning is if you don't die, don't have a trauma, don't have a loss of income or property, then the risk being covered hasn't been realised.

For example, if you have a $500,000 mortgage and have a $1,000,000 life policy and you make it to retirement having paid off the mortgage. Then you have likely paid double what you needed to, to transfer the risk. Assuming your need was limited to just the mortgage over that time.

Read more