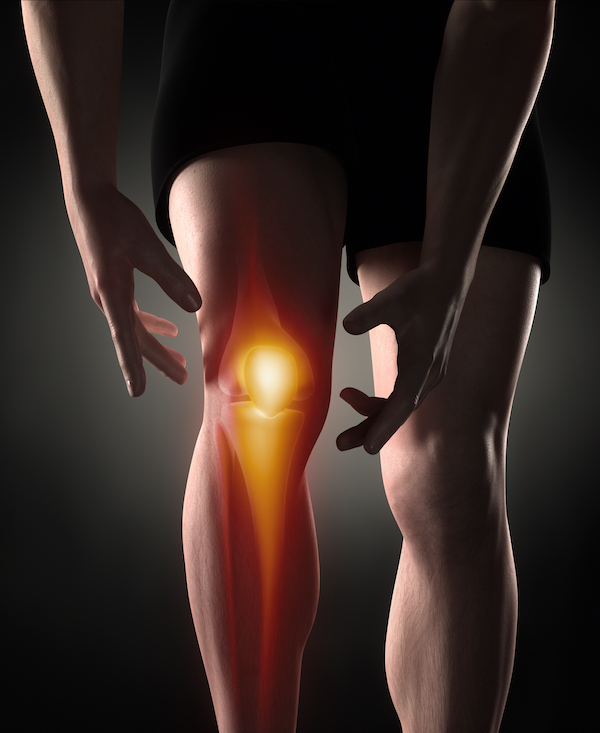

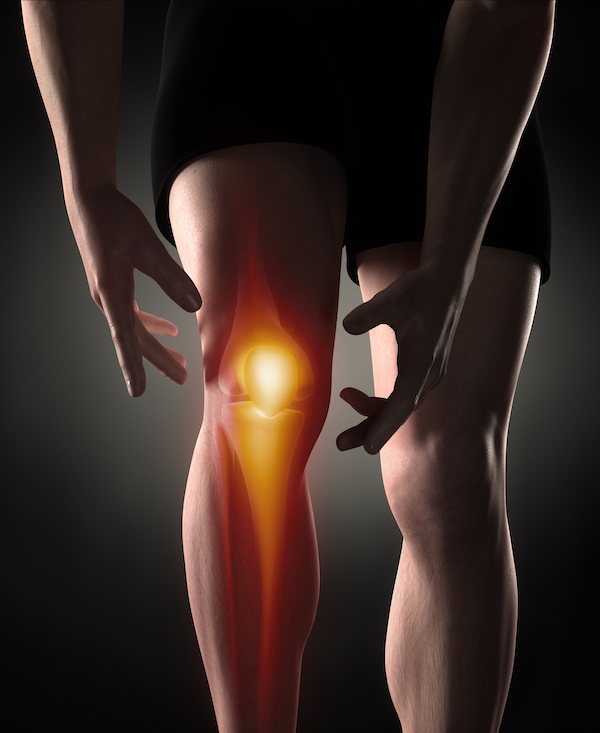

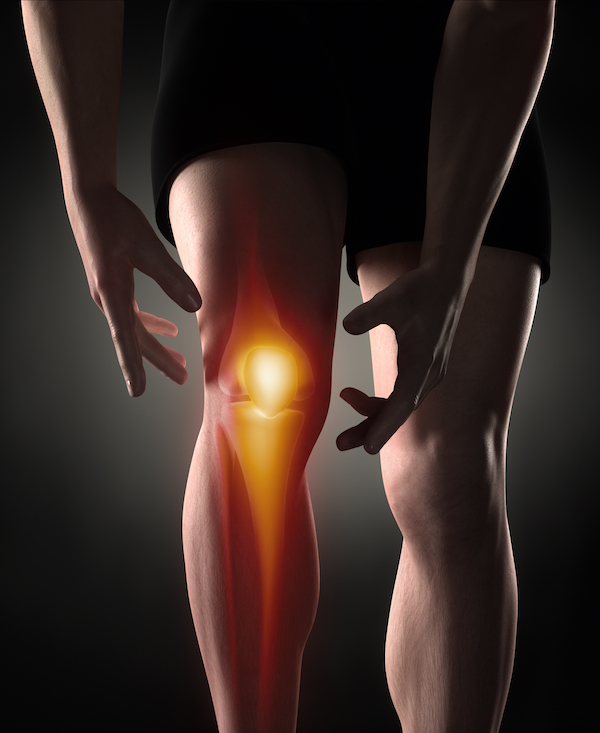

ACC (Accident Compensation Corporation) is New Zealand's unique no fault accident rehabilitation and support system

Ok, most of you know about ACC covering you for your medical expenses to treat you and recover from an accident.

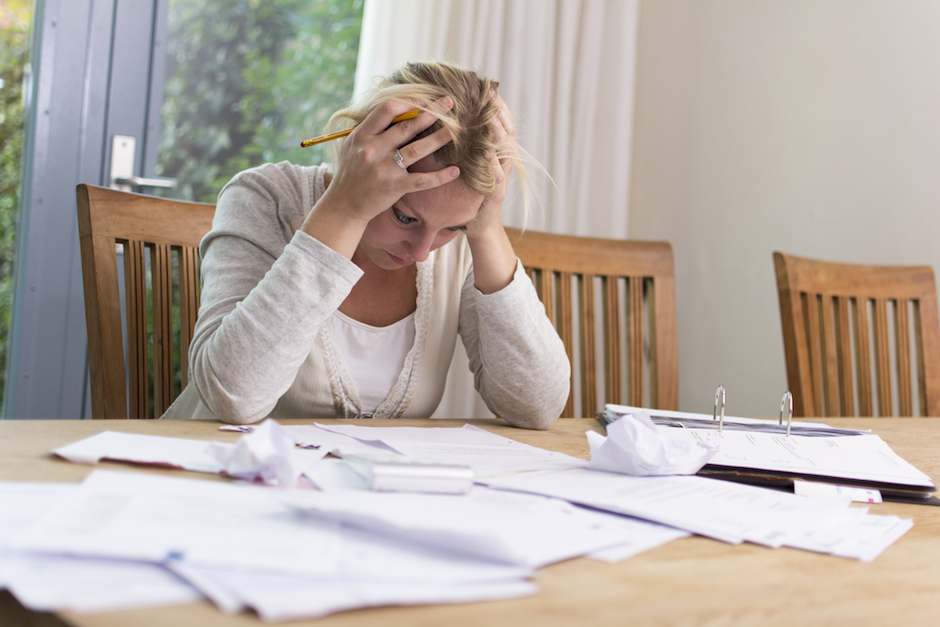

If you have had an accident you probably found this to be partially funded and you had to pay something towards the costs, depending on what you needed to be done. Which is a little disappointing but medical expenses only go so far.

The other aspect people know about is the replacement of income if you are off work in an accident situation, where 80% of your lost income can be replaced after seven days while you recover.

The things people may not fully appreciate are the other benefits and situations ACC cover which you need to be aware of.

Read more