From time to time I get updates through from insurers with their claim stats. I recently posted a blog on medical coverage for un-funded medicines and had a look at insurance literacy for clients.

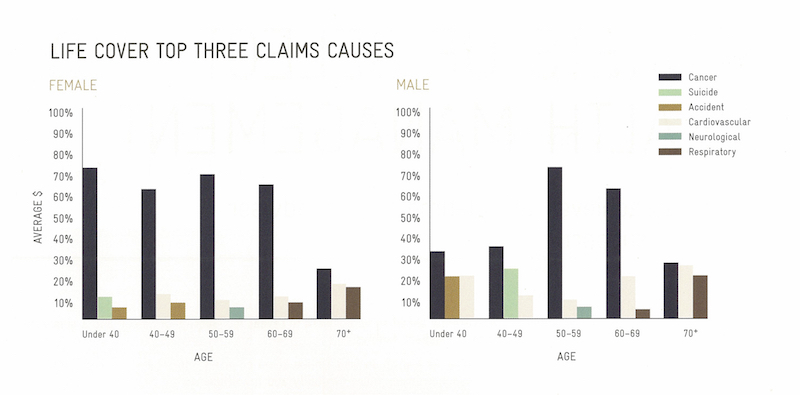

I like information, the sort of information that gets away from the typical and very usual FUD. Fear Uncertainty & Doubt that my industry often trades on to get sales.

I rant a bit in this one; it is an issue we, collectively, don't spend enough time and energy on.

It is been commented in many online forums, that the scaring and very pushy what if? Isn't appreciated. I must admit I do not like it much either. Which is why I try and stay away from it and deal with the facts.

Part of the reason people take longer to make decisions, but they do make better decisions as a result.

My point, while I do not trade on FUD, I certainly have some disturbing stories and stats. Some may look on the surface as FUD. They are based on the reality of you and me, the average person.

The person getting on with life, family and business and gets knocked over with something unexpected and often unplanned for.

What’s this post all about?

It is about you, your health and how you can access treatment in a more effective way.

Read more