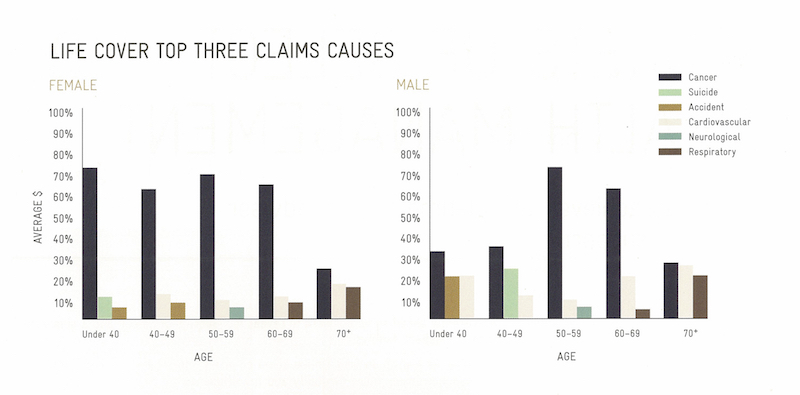

Diana’s Clements recent article on heart attack definitions in trauma insurance and the situation of a claimant in Australia, not getting paid for his heart attack, has put the spot light on the definition of a heart attack in trauma insurance here.

Looking into heart attack definitions in the market, from what you can presently buy, the quality level across heart attack definitions is quite surprising.

There has been plenty of contention about Sovereign heart attack definitions over the years. The rating for this would suggest it’s somewhat founded, with a 21% gap between it and the best rated heart attack definition.

As our largest life insurer, Sovereign also has the largest number of trauma policies on their books.