One of the things that is often said, reported in the news, and generally complained about are the increasing costs of medical insurance.

We've heard about Southern Cross policyholders up in arms because of the premium increases they have seen. To be fair, all providers' premiums increase; Southern Cross has the biggest pool of clients and the oldest pool of clients, so increases do hit hard in that particular group.

This article has been updated here, and this one has been maintained for historical reference.

The reality is every year you get older, the risk of you having a significant medical event increases, and so does the cost of that medical event. Companies could do a flat premium approach, but this would have the younger lives subsidising the older ones. The older ones would love it, the younger ones not so much, well, until they become the older ones. A company trying this would likely not have young clients, as they would be with the insurers with the approach we have now, and thus wouldn't survive long underpricing their policies.

So where am I going with this?

The reality is the type and structure of your medical policy throughout your life aren't going to remain the same because different stages require different approaches. When you're looking at medical insurance, you're often basing decisions on this policy remaining in a place untouched and unchanged for 40-plus years; it's blatantly unrealistic. But people decide on their policies in this way.

The point of this post is to step you through what those changes might look like and give you an idea about the resulting cover and associated premium costs. What will surprise you is I can provide coverage for a 75-year-old couple with a similar premium to a 30-year-old couple with kids. It is a matter of structure and alignment with available resources, but it is possible.

Let's get started:

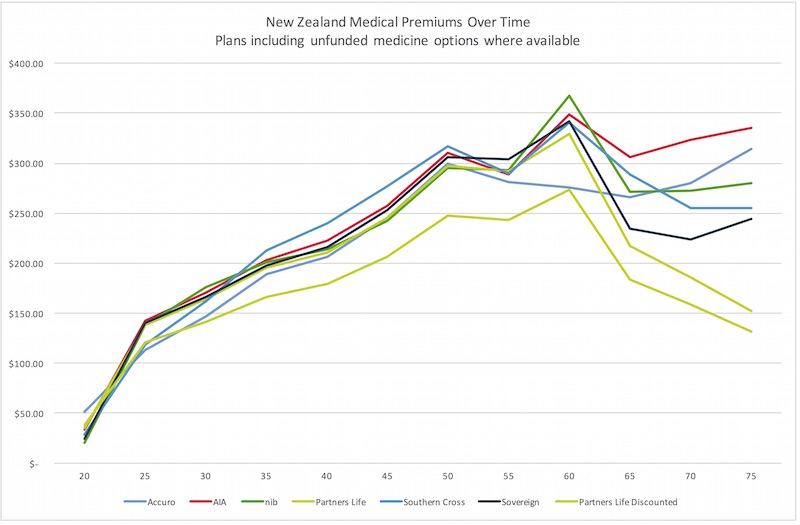

The chart below outlines what I'm going to step you through. As you can see, it starts pretty tight and widens out in middle age. Once you approach retirement, it gets a bit squiggly.

Premium is accurate at the time of publishing, based on standard premium rates and subject to a medical assessment. Discount premiums require additional policy benefits to access that may or may not be appropriate for an individual situation. Some providers have additional plans available; the most equivalent plans have been used for comparison purposes.

20:

Ok, you’re 20, you have medical insurance probably from your parents, though you may have arranged it yourself. The most likely scenario is you have it from your parent’s plan, and they’re probably still paying for it. The average premium at this stage for a hospital plan with specialists & tests and a $250 excess is going to be about $33 per month or about $1 per day.

25:

Roll on a few years, and you’re 25, partner on the scene, and you’re clear of the children's premium rates that you may have been on when you were 20. Cover needs haven’t changed, though adult premiums have had an impact, as the monthly premium is now $130 per month for you both.

30:

30 rolls around, and there’s been a few changes; married and baby, things have changed quite quickly. The average age of a bride is 28.5 years, and the groom is 30 in NZ presently. With Mum for the first time at about age 30. With the addition of bubs, your premiums have increased a bit to $160 per month on average.

35:

A few years later, at age 35, number two is on the scene, and the first one is off to school; you need for the type of cover hasn’t changed much, but the premiums are now approaching $200 per month.

40:

40 rolls up and hits you from behind. The kids are well into school, and there’s been a few specialists and tests done, and one of you may have had surgery. Things are starting to show up, and your cover is now returning some of that value you’ve really wanted to avoid. Premiums haven’t moved a great deal, with an average of $212 per month. If you were to take cover now, you’d face exclusions for pre-existing conditions, which also means moving between providers will have a similar issue.

45:

45 whistles up, and the kids are in high school; there maybe some additional resources available to increase the excess; at this stage, it’s not going to make a lot of difference, and there’s a test pending, so we leave it be. Average premiums have been slowly creeping up; it’s now approaching $250 per month.

50:

50 comes round faster than you wanted; you still feel like you’re 30, so why are the premiums getting so high at about $300 per month? The kids are at Uni and soon to be off your hands, though not as soon as you may like. Some providers are starting to charge an adult premium for the kids. We leave it be as the kids will come off, and that will help.

55:

55 now, we need to get serious about the retirement plan. This medical insurance premium needs to be better managed. We’ve dropped the kids off on their own policies, and we look at increasing the excess to $500; this brings the average premium back under $300 per month, at $284 per month.

60:

60 arrives, you’ve had a serious claim, and there are a few medical things going on; we need to retain the cover but ensure it does a good job when it's needed. There’s still the occasional specialist appointment happening, so we look to increase the excess to $1,000 at this review. The average premium comes back to $325 per month.

65:

Retirement and age 65, the key focus is substantially reducing costs as income is reduced. This is where we make a couple of tough decisions, increase the excess to $2,000 and drop the specialist and testing option. This means specialists and tests will only be covered if there is an associated hospital admission. Which isn’t too bad as there are funds available to cover specialists if needed. The average premium comes back to $250 per month with this reasonably aggressive approach.

70:

70 comes around much faster than you wanted, and premiums have been creeping too. Retirement savings and plans have gone better than expected; we look at increasing the excess to $4,000 to keep premiums affordable at $242 per month. The range of premium at this point is $158 to $323 per month, depending on the provider.

75:

At age 75, we push the excess out as far as we can. For some providers, that was done at the review at age 70; for others, we have a $10,000 excess option. This means the really serious things will still be covered; anything minor is likely to be at your cost. Financially things haven’t been too bad, and premiums are now in the $131 to $334 range for both of you. This is where it was when you were 25-30.

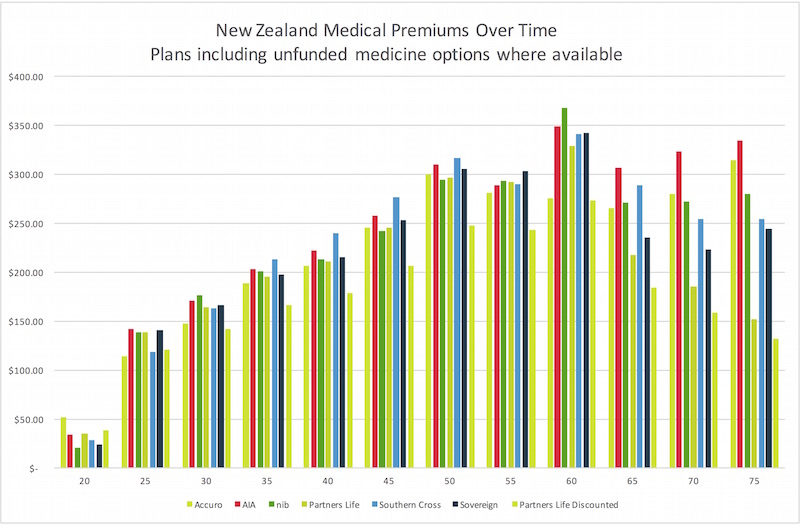

The graph below covers the same information as above, though it gives a better view of what each provider is doing at a particular age.

Premium is accurate at the time of publishing, based on standard premium rates and subject to a medical assessment. Discount premiums require additional policy benefits to access that may or may not be appropriate for an individual situation. Some providers have additional plans available; the most equivalent plans have been used for comparison purposes.

Summary:

Looking across all providers and all ages for this sort of typical scenario, the average premium is $218 per month. Some providers will be consistently positioned, and some will be across the spectrum as age and policy structure have a bigger impact than with other providers.

This is an outline of a typical medical insurance strategy and one that plays out every day. This isn't my advice at work; these are the decisions clients make once they have the information to make an informed decision, decisions that affect them. Being able to discuss the options means you retain valuable benefits that you may have otherwise cancelled because you saw no other option.

I’ve seen people with very few claims and others who have had multiple claims and had thousands paid. For example, a couple of knees and a bypass, $85,000 within 3 years, and cancer surgery and treatment, $180,000. Sometimes it's nothing for years and years, then bang, it's a run of significant claims, other times it is a consistent run of more minor things, but they add up in the same way. Everyone is different; that's sort of part of my point.

These aren’t small numbers, and most New Zealand families would be hard-pressed to fund them. Your average medical policy provides $600,000 to $1,000,000 of coverage per person per year. The majority of people get nowhere near that in one year, let alone a lifetime, but it’s there if it’s needed.

If you take cover at 30 for you and your family, hold it until age 75; as I’ve outlined, on the average premium across all providers, you’ll pay about $117,720 in premiums, which is a reasonable chunk of money. Remember, this is over 45 years, and that’s a long time for trying to save this.

If you and your family have $10,000 of claims every year, which is probably unlikely, but possible, you’ll have an insurance return of $450,000 straight off. If we look at average incomes over this time, it equates to just under 5% of gross income. Imagine what our health system would look like if it had 5% extra funding from a direct tax. I probably wouldn't be having this chat with you, and I'd be talking about something else. Unfortunately, it's not going to change in a hurry; medical insurance is a significant need in society.

If you take the cheapest option of this group, which is actually a good policy, then you’re going to be about $23,000 better off over than the average. If you take the most expensive plan, then you’re going to be about $14,000 worse off than the average and still be on a reasonable plan.

Interestingly the plan in the middle of the pack is the one with the least resources available to cover you in the future.

So is it worth it? Definitely!

Have a chat with us about how you can do this in a cost-effective way for you so you get the best treatment options available for your premium $ so that it’s affordable into the future for you and your family.

Terms & Conditions

Subscribe

My comments