This is an update to a similar article I wrote in 2016, and this shows in the seven years since, medical insurance premiums have mostly doubled and what has changed since then. Added to that is access to public health services is at an all-time low, with around 2/3 of people not being seen in required Ministry of Health time frames.

Don't take my word for it; you can check out Public Health services delivery response that is linked, though this hasn't been updated since before the 2023 election. Click time series view, and it will show you how well current public health delivery is achieving to expectations.

In the last eight years, we have seen significant changes in medical insurance, we had six providers and seven distinct options, and now we have five providers and fewer options. Partners Life removed its bundling discount effect and reduced its standalone medical cover premium to the discounted bundled rates and we have had the sale of Accuro to UniMed that takes effect 1 June 2024.

However, what was an outlier on unfunded medicines is now provided in some way with every provider we utilise. UniMed is the only provider that sits outside this group where they focus on employee benefits and don't compete directly in the retail medical insurance advice space.

My continued message is you need to regularly review your cover to your changing needs

The reality is the type and structure of your medical policy throughout your life aren't going to remain the same because different stages require different approaches. When you're looking at medical insurance, you're often basing decisions on this policy remaining in place untouched and unchanged for 40-plus years; it's blatantly unrealistic. But people decide on and operate their policies in this way.

The point of this post is to step you through what those changes might look like and give you an idea about the resulting cover and associated premium costs. What will surprise you is I can provide coverage for a 75-year-old couple with a similar premium to a 30-year-old couple with kids. It is a matter of structure and alignment with available resources, but it is possible.

Let's get started:

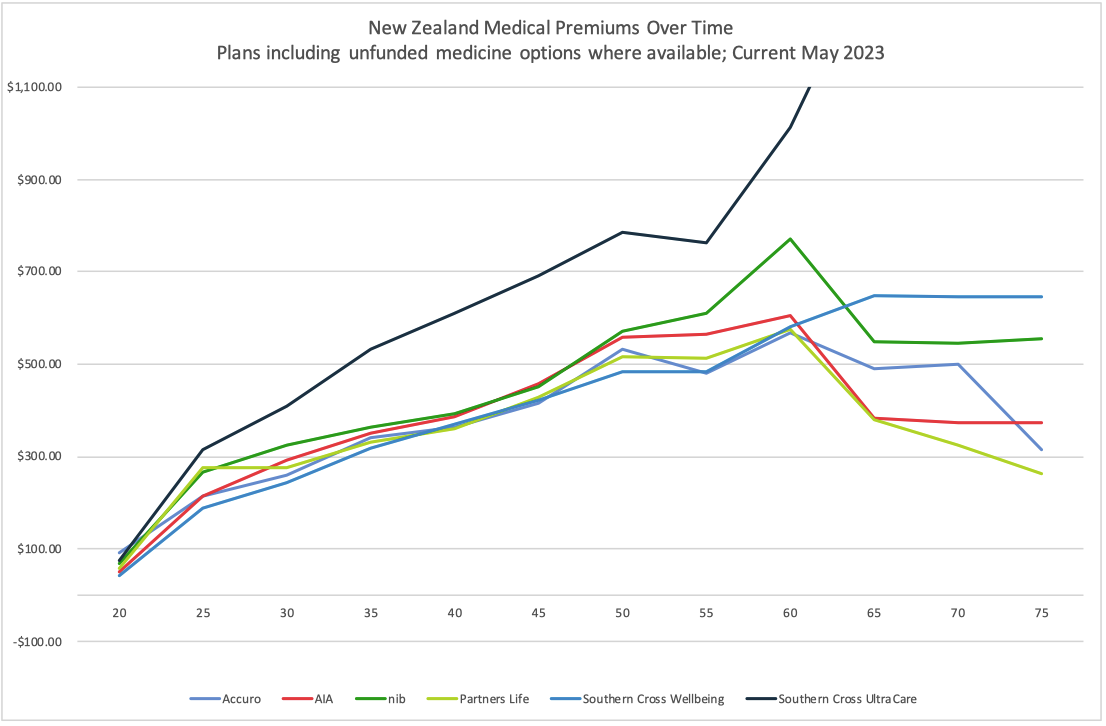

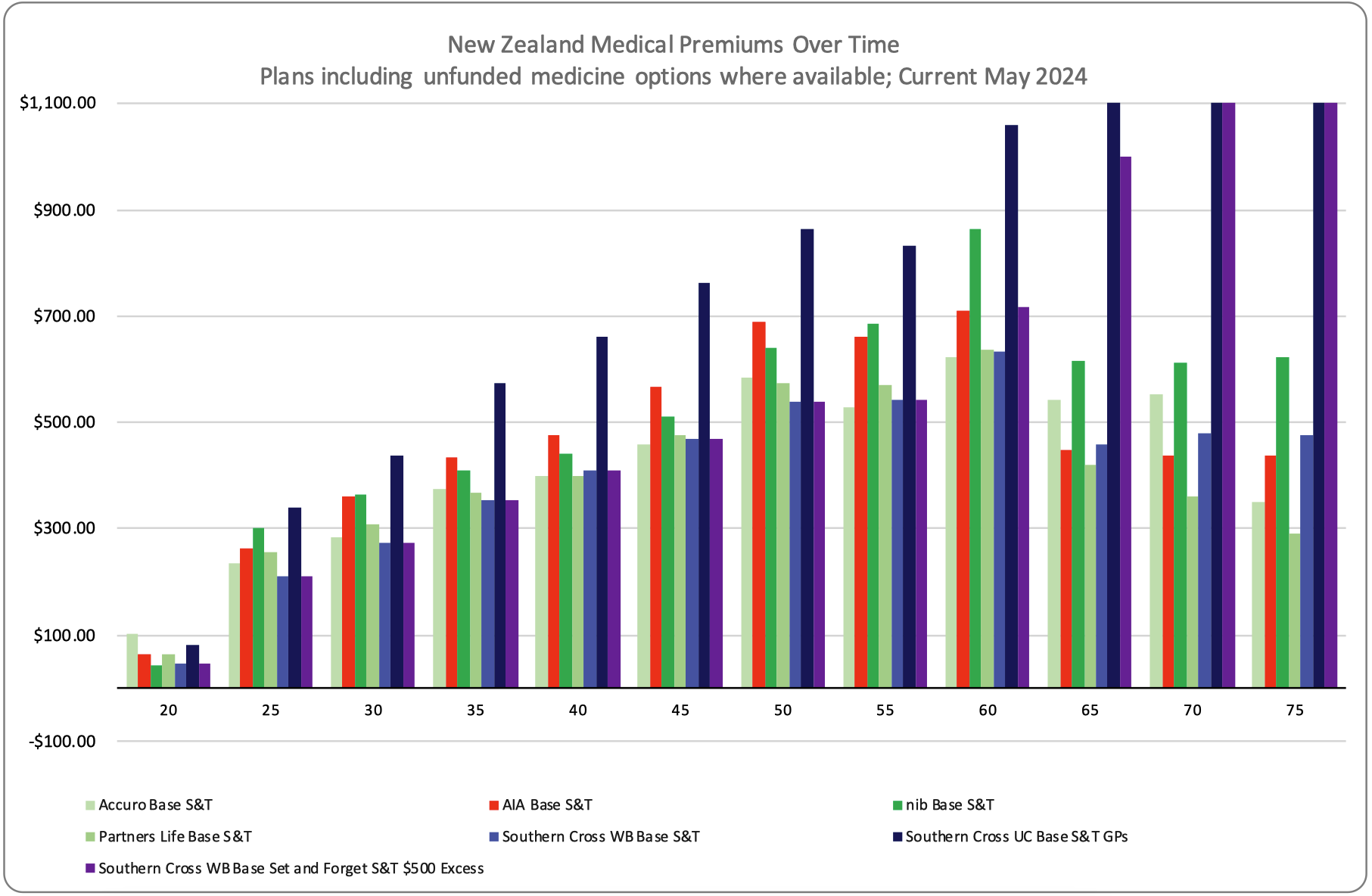

The chart below outlines what I'm going to step you through. As you can see, it remains pretty tight until around 50, then it spreads, and once you approach retirement, it gets a bit squiggly. Interestingly when compared to 2016, there was significantly more variation in premiums between 25 and 50.

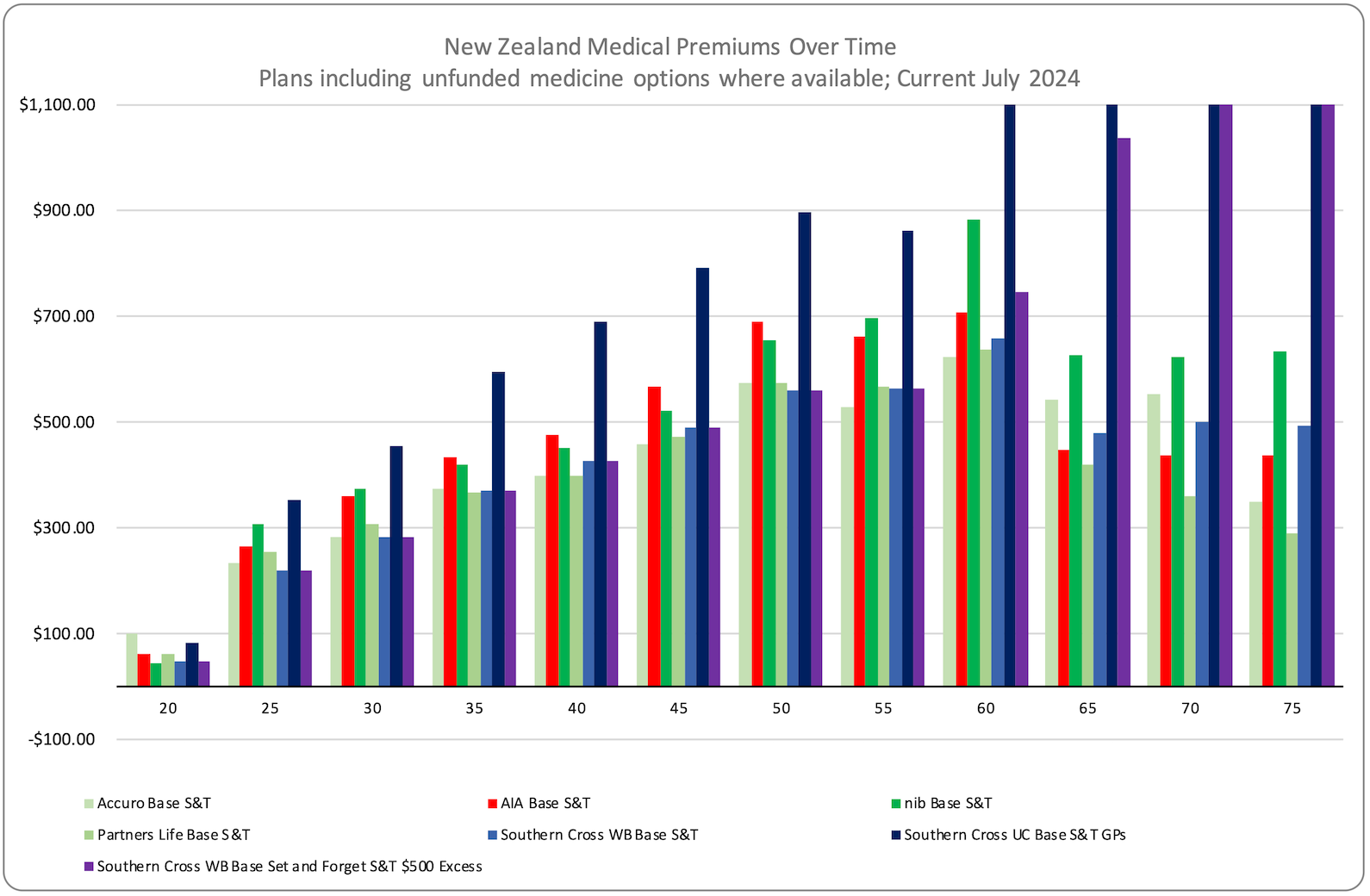

The clear message here is those on UltraCare, while beneficial in many ways, especially for pre-existing conditions qualification, you want to be looking at moving to Wellbeing plans as soon as possible; this is specifically one point where you need to be talking to us, as we can restructure this cover and preserve your pre-existing condition coverage.

- Also, with UltraCare, it is the only product used here that includes GP and prescription costs, so it is expected to be more expensive than the average. However, the premium increase after age 55 is astoundingly dramatic and anyone over age 55 with it, needs to seek advice now!

This is the picture from May 2023

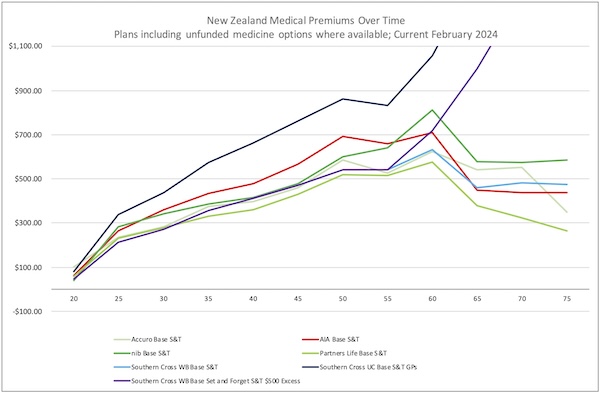

This is the picture 12 months later in May 2024

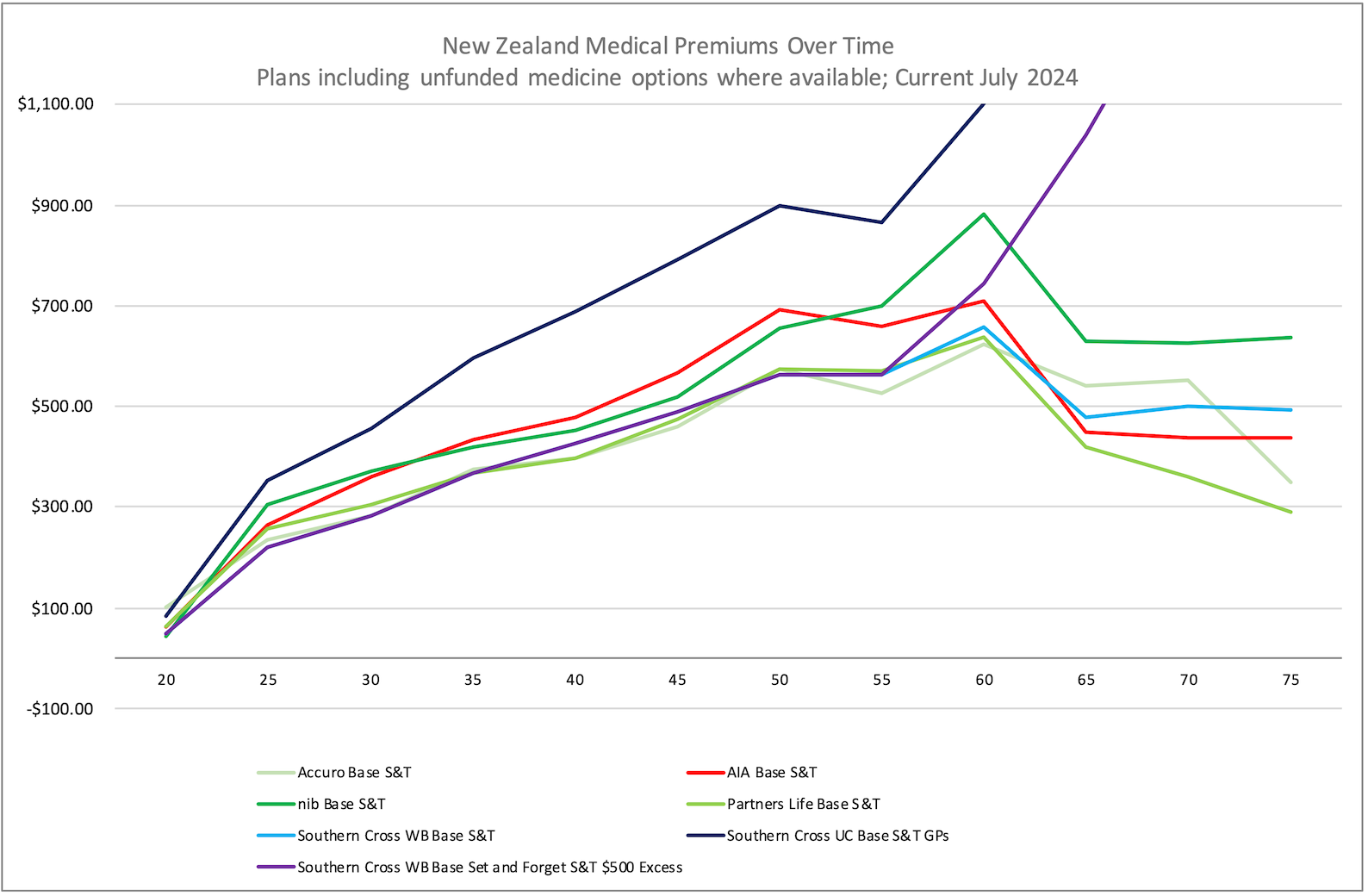

And this is the picture from July 2024.

Premium is accurate at the time of publishing, based on standard premium rates and subject to a medical assessment. Some providers have additional plans available; the most equivalent plans have been used for comparison purposes. The Southern Cross premiums illustrated do not have the unfunded medicines option added and are an additional premium to this illustration.

The following uses May 2023 premiums for the examples, this is a work in progress.

20:

Ok, you’re 20, you have medical insurance probably from your parents, though you may have arranged it yourself. The most likely scenario is you have it from your parent’s plan, and they’re probably still paying for it. The average premium at this stage for a hospital plan with specialists & tests and a $250 excess is going to be about $67 per month or about $2.25 per day. Yes, double what 2016 looked like.

25:

Roll on a few years, and you’re 25, partner on the scene, and you’re clear of the children's premium rates that you may have been on when you were 20. Cover needs haven’t changed, though adult premiums have had an impact, as the average monthly premium is now $271 per month for you both.

30:

30 rolls around, and there’s been a few changes; married and baby, things have changed quite quickly. Checking the 2018 census data, the birth age of mum around 30 has been steady for about 10 years, making bubs arriving now still the usual. With the addition of bubs, your premiums have increased a bit to $344 per month on average.

35:

A few years later, at age 35, number two is on the scene, and the first one is off to school; your need for the type of cover hasn’t changed much, but the premiums are now approaching $426 per month.

40:

40 rolls up and hits you from behind. The kids are well into school, and there have been a few specialists and tests done, and one of you may have had surgery. Things are starting to show up, and your cover is now returning some of that value you’ve really wanted to avoid. Premiums haven’t moved a great deal, with an average of $473 per month. If you were to take cover now, you’d face exclusions for pre-existing conditions, which also means moving between providers will have a similar issue.

45:

45 whistles up, and the kids are in high school; there may be some additional resources available to increase the excess; at this stage, it’s not going to make a lot of difference, and there’s a test pending, so we leave it be. Average premiums have been slowly creeping up; it’s now approaching $550 per month.

50:

50 comes around faster than you wanted; you still feel like you’re 30, so why are the premiums getting so high at about $658 per month? The kids are at Uni and soon to be off your hands, though not as soon as you may like. Some providers are starting to charge an adult premium for the kids. We leave it be as the kids will come off, and that will help.

55:

55 now, we need to get serious about the retirement plan. This medical insurance premium needs to be better managed. We’ve dropped the kids off onto their own policies, and we look at increasing the excess to $500; this brings the average premium back under $650 per month at $646 per month. This is still $100 per month more than 2016 for the same point.

60:

60 arrives, you’ve had a serious claim, and a few medical things are going on; we need to retain the cover but ensure it does a good job when it's needed. There are still occasional specialist appointments, so we look to increase the excess to $1,000 for this review. The average premium comes back to $768 per month.

65:

Retirement and age 65, the key focus is substantially reducing costs as income is reduced. This is where we make a couple of tough decisions: increase the excess to $2,000 and drop the specialist and testing option. This means specialists and tests will only be covered if there is an associated hospital admission. This isn’t too bad as funds are available to cover specialists if needed. This reasonably aggressive approach returns The average premium to $667 per month. This is only $27 per month more than 2016. Older age premiums are trending more stable than younger ages

70:

70 comes around much faster than you wanted, and premiums have been creeping up, too. Retirement savings and plans have gone better than expected; we look at increasing the excess to $4,000 to keep premiums affordable at $494 per month, or $718 if including UltraCare in the average. The premium range at this point is $358 to $625 per month, depending on the product and provider. (Those on Southern Cross UltraCare have either cancelled or restructured by now)

75:

At age 75, we push the excess out as far as we can. For some providers, that was done at the review at age 70; for others, we have a $6,000, $8,000 or $10,000 excess option. This means the really serious things will still be covered; anything minor is likely to be at your cost. Financially, things haven’t been too bad, and premiums are now in the $291 to $6635 range for both of you. This is where it was when you were 25-30 with the lower end.

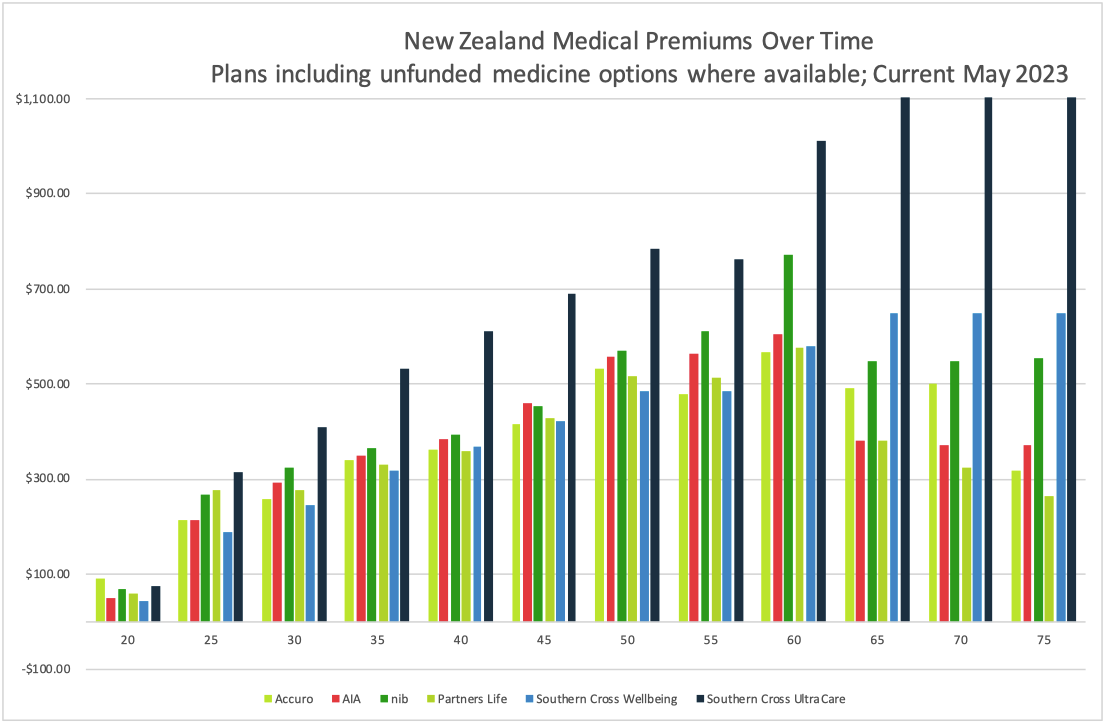

The graph below covers the same information as above, though it gives a better view of what each provider is doing at a particular age.

This is the picture from May 2023

This is the picture 12 months later in May 2024

And this is the picture from July 2024.

Premium is accurate at the time of publishing, based on standard premium rates and subject to a medical assessment. Some providers have additional plans available; the most equivalent plans have been used for comparison purposes. The Southern Cross premiums illustrated do not have the unfunded medicines option added and are an additional premium to this illustration.

Summary:

Looking across all providers and all ages for this sort of typical scenario, the average premium is $493 per month, including UltraCare and $416 per month without UltraCare in the mix. Some providers will be consistently positioned, and some will be across the spectrum as age and policy structure have a bigger impact than with other providers.

This average cost of coverage hasn't moved significantly, as the lower younger years have been where the increases have happened, and proportionately, the bulk of the premiums paid are with older ages.

- This is an outline of a typical medical insurance strategy and one that plays out every day.

- This isn't my advice at work; these are the decisions clients make once they have the information to make an informed decision, decisions that affect them.

- Being able to discuss the options means you retain valuable benefits that you may have otherwise cancelled because you saw no other option.

I’ve seen people with very few claims and others who have had multiple claims and had thousands paid.

- For example, a couple of knees and a bypass, $85,000 within three years,

- and cancer surgery and treatment, $180,000.

Sometimes, it's nothing for years and years, then bang, it's a run of significant claims. Other times, it is a consistent run of more minor things, but they add up in the same way.

- One client in the last 3-4 years has had $6,200 in specialist treatments

- and another nearly $20,000 in claims for head injury treatment in addition to what ACC funds.

- Another $76,000 for four weeks of cancer treatment, some of that unfunded.

- The largest claim we have had that's not unfunded medicines is $265,000 for multiple surgeries for cancer in a femur. That client now has a bionic leg from hip to below the knee.

Everyone is different; that's part of my point.

These aren’t small numbers, and most New Zealand families would be hard-pressed to fund them. Your average medical policy provides $600,000 to $1,000,000 of coverage per person per year. The majority of people get nowhere near that in one year, let alone a lifetime, but it’s there if it’s needed. (Ignoring the couple of insurers that don't limit their surgery benefits)

If you take cover at 30, when most people start looking for coverage, for you and your family and hold it until age 75, as I’ve outlined, on the average premium across all providers (including UltraCare), you’ll pay about $266,542 in premiums, which is a large chunk of money. Remember, this has been over 45 years, and that’s a long time to try to save this. Without UltraCare, that average premium is $225,034. Since 2016, the average has increased by about $20,000 in total.

If you and your family have $10,000 of claims every year, which is probably unlikely but possible, you’ll have an insurance return of $450,000 straight off. If we look at average incomes over this time, it equates to around 5% of average gross income.

- Imagine what our health system would look like if it had 5% extra funding from a direct tax. I probably wouldn't be having this chat with you, and I'd be talking about something else.

- Unfortunately, it's not going to change in a hurry; medical insurance is a significant need in society.

If you take the cheapest option of this group, which is a good policy, then you’ll be about $68,842 better off than the average. If you take the most expensive plan (UltraCare), then you’re going to be about $207,539 worse off than the average.

If we consider the spread on the plans excluding UltraCare, your range is $39,721 more than average to $27,334 less than average.

Interestingly, the Southern Cross Wellbeing Two plan in the middle of the pack has the fewest resources available to cover you in the future, so cheaper isn't always ideal. The cheapest plan on average is Partners Life and it is one of the best plans on the market.

- That said, it is questionable that Partners Life continues to be the cheapest plan on the market, as this is not how the market works.

In terms of product quality, what the rating houses Quotemonster and Strategy Financial Services say, with my overlay opinion on what this translates to the order of quality is as follows.

- Partners Life & nib (largely equally as good, and the nuances will be down to personal preference)

- Accuro (because it is a good product, but it is not guaranteed, and they have been sold to UniMed, so the jury on long-term support is still out)

- AIA solid coverage and caters to unfunded cancer medicines, whereas the ones above also cater to non-cancer unfunded medicines.

- Southern Cross, though the discussion on cover security with their penchant for changing benefits and general lack of unfunded medicines support need considering.

- UniMed, which I have not included in the above, though with the Accuro purchase, that will change. Historically, these policies have been well behind the rest, though recent changes have improved their product rating.

Premium pressures and new products:

Insurers have been seeing the impact on people, with continuing rises in premiums and premature cancellations or reductions in coverage.

- This has opened the door to new benefits that are cut-down forms of some of the full-spectrum products, including coverage focused exclusively on cancer care or the big 5-6 conditions like hips, hearts, cancer, knees, and stroke.

- Sovereign's Key Health product, delivered back in 2005, I think it was, and since discontinued, was ahead of its time; this sort of product today has some merit for those looking for a budget option for their medical insurance.

- A balance of either using public health or paying your own way privately for minor conditions but having the support of insurance for the really big stuff.

I expect that we will continue to see an evolution of cover in this space as insurers juggle things to provide more strata to the present medical insurance structures.

Is Medical Insurance worth it? Definitely!

Have a chat with us about how you can do this cost-effectively so that you get the best treatment options available for your premium money and it’s affordable for you and your family in the future.

Terms & Conditions

Subscribe

My comments