This has been an interesting topic of discussion in the last few weeks. Brought about by two clients facing breast cancer.

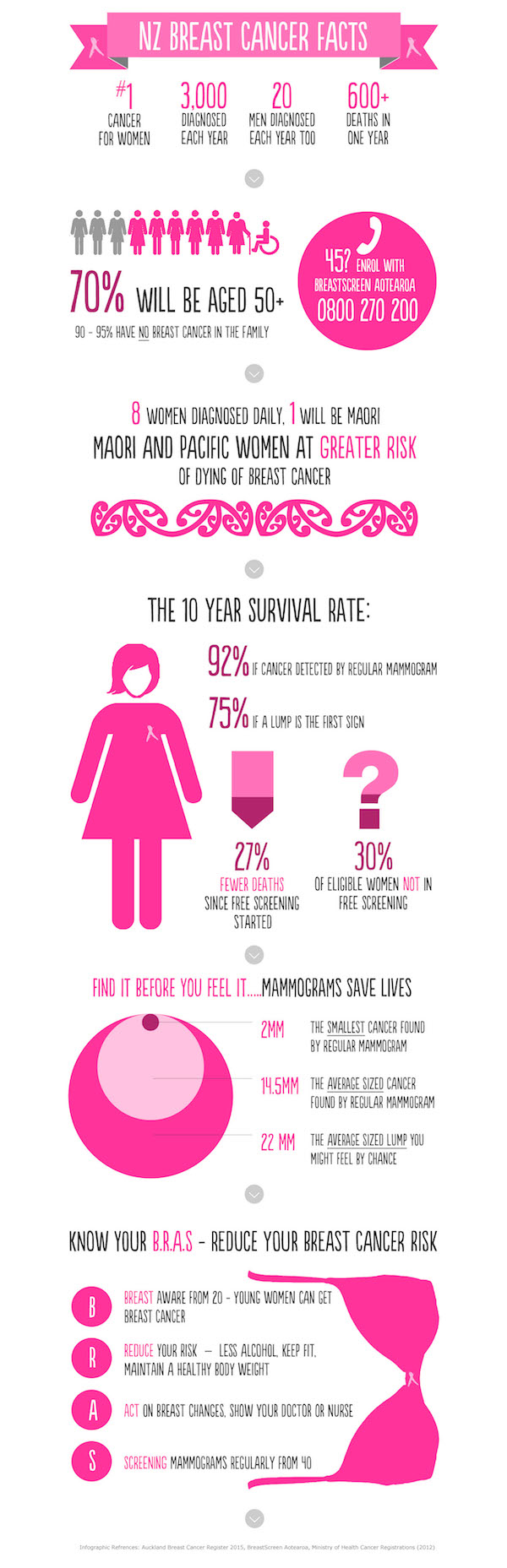

Checking the stats on the New Zealand Breast Cancer Foundation website the diagnosis rate of breast cancer in New Zealand has been steadily climbing in the last 20 years. From around 2,000 diagnosed per year to around 3,000 diagnosed per year presently.

This probably isn't surprising given that our population has grown too. What is pleasing to see is the mortality rate is improving relative to the number diagnosed.

Not that a death rate of 600 - 650 people per year is pleasing, my own mother was one of those in these statistics. More the point; medical technology really is making a difference.

While a reducing mortality rate is desirable, an increasing mortality rate is not happening; this is positive.

So what does this have to do with trauma cover?

A whole lot actually!

If you look at the development path of trauma products, those coming out of the 90's and earlier only start to respond once cancer has got very invasive. The premiums on these policies appear attractive, but they hide a high bar you need to cross to get a claim.

With policies in the 00's and earlier this decade improving on them and introducing both early cancer benefits and pass back benefits.

Early cancer is intended to pay where cancer is detected early and treated effectively with minimal impact on lifestyle and recovery and has a partial payment of the trauma cover, 10-25% typically.

Pass back is where new policy developments, improvements, are passed back to earlier policies where there isn't a price increase as a result. This is where it gets a bit murky.

It is not easy looking at a policy to understand what pass back options have been applied. As some have and some have not depending on the premium rule. Some pass back across the range, some pass back only so far. Confusing for you and advisers alike. Not an easy one.

When we stop and have a really close look at policy definitions, things start to unravel slightly. Most of this is due to the changes in medical technology I outlined in the stats.

With medical technology discovering and treating breast cancer at a much earlier stage, recovery is easier, and survivability is significantly improved.

By the stats, you are about 30% more likely to survive breast cancer today than you were 20 years ago. That is a huge improvement.

So what has that got to do with trauma cover?

Ok yes, I'm rambling a bit, but only to give you the background to appreciate what follows.

What this means is trauma cover is not responding as well as it used to for many facing the diagnosis of breast cancer.

No, I do not mean the cover has got worse, more the case the diagnosis is earlier, so the medical severity bar, as measured by trauma policies, is lower than is required to qualify for a full claim and partial claims are becoming more common.

In the past, cancer would have progressed further before being detected and thus more severe, and the trauma cover would pay in full.

So this is a good thing, right?

Yes and no. Yes because the diagnosis is earlier and treatment less severe to deal with. No, because the expectation of the policyholder is I have been diagnosed with breast cancer where's my trauma claim? Moreover, it is not turning up as expected.

Ahh, so that's just the insurance companies being pricks! No, it's the contract you the policy holder have and it hasn't been updated with the times.

Let's look at one of the examples I have recently worked through.

I am going to leave insurance companies out at this stage, as most companies at the times mentioned would have had the same answer. So it is not appropriate to single one or two out. We will talk about that later.

Stepping back in time to 1999, Jane buys a policy from insurer A it includes trauma cover. Ten years later in 2009 after having kids, Jane buys additional trauma cover from insurer B.

Another seven years later Jane's sister gets diagnosed with breast cancer and decides to get herself checked. Just as well as they find something. It's Ductal Carcinoma In Situ (DCIS) of the breast. Surgery is scheduled.

The discussion was full mastectomy or partial, or lumpectomy? The surgeon decided on a lumpectomy. This is then followed by radiotherapy and tamoxifen for five years.

Jane at this point has lost track of her adviser, something that is quite common, so gives us a call. That is right we did not arrange the original covers, but we are helping with the claim.

Looking at the 1999 policy from insurer A the diagnosis of DCIS is specifically excluded at this level in the policy wording. No claim here and before pass backs were applied with this insurer.

If the cancer spreads then yes, this policy will still respond, but it is got to be significantly more severe in diagnosis.

Let's look at the 2009 policy; again DCIS is excluded from the main cancer benefit unless it results in a full mastectomy or radical surgery, which is defined as removal of the entire organ. However, it is included on the partial claim. Ok, we have got a claim for 25% of the trauma coverage.

But again looking at the diagnosis, if the DCIS had gone a bit further before being detected, the treatment would have been the same. This may have upgraded the claim to a full claim by definition of the cancer being malignant, but the treatment would be the same, hang on?

Same treatment but ones a partial claim and ones a full claim, say what? Yes. Insurance policies can be quite coarse in their definitions and when the line is drawn it is very easy to find a case or two that sit right on either side of that line even though the treatment may be the same.

Oh, that's not so good.

Yes, that's right.

We cannot argue that insurer C has a better policy wording for the same price so pay up because that is their contract, not your policy contract.

The Financial Markets Authority, the guys who regulate us advisers, have said consumers need to keep upgrading your policies until you can't. Usually, because your health precludes it. They have also done a report, don't switch consumers if it is not in their best interests first.

Which we fundamentally agree with, clients first.

Which brings me to the very point of this article.

If you have a trauma policy that hasn't been reviewed for a few years, you really do need to dust it off and review it.

- Today company B has the same definition as the 2009 policy in their current trauma contract because pass backs applied.

- Company A have moved along significantly with their current policies and have a similar definition today as company B.

Looking around at the policy wordings for cancer:

- One insurer adds radiotherapy and chemotherapy to the definition around DCIS. However, the AND in the sentence with radical surgery brings this back to insurer A and B's definition and a partial payment outcome for our example.

- Another insurer has faced up to the fact this type of diagnosis is still as traumatic as a more invasive diagnosis with the same treatment; so they would consider the same situation in our example a full claim. Their definition says radical surgery, radiotherapy or chemotherapy, making the the DCIS example above a full claim.

Interestingly the premium for this last insurer and company B is the same. Which would you prefer to have?

If this disturbs you, and it should, then give us a call to review your insurance cover in a way that is more meaningful to you.

Paying good premium and missing out on a claim when you need it is not what insurance is about. Get it reviewed!

Infographic from New Zealand Breast Cancer Foundation

Terms & Conditions

Subscribe

My comments