From time to time, I hear key staff from insurance companies speak at training and development sessions I attend. A recent one I heard from a key person in charge of operations. This person oversees both the underwriting (your application) and claims (where you get paid)

What was interesting to hear was the statement ‘Where there is adviser guidance with the application; the client generally has a better outcome at claim.’

Why is this important to you?

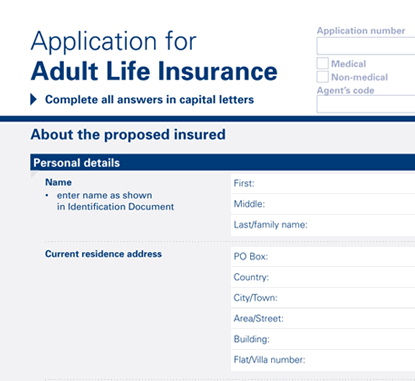

Very simply, if you are working through an insurance application and you have an adviser involved, you get better guidance on what the insurance company is looking for from the questions asked. You will also get prompted to disclose that little thing 10 years ago that you might not have otherwise disclosed if you had been working through this on your own.

Questions on the application can be a bit vague to those not used to them, conditions you are suffering from; this is a bit grey but falls into the requirements of disclosure. That chest pain you have been having but have not done anything about, that needs to be disclosed.

What is the question for you?

Do you have insurance cover where you were left to your own devices to fill in the application?

If you have then there is the chance you may have missed something. Yes, that little thing 10 years ago could be significant in the context of your claim. The not so little as well; one I came across with some direct insurance that was some years old was the chemotherapy he was just starting when he applied for his cover.

Take it to the extreme, let us say you have had high cholesterol in your 30’s where nothing but diet was recommended and it settled down. You applied for trauma cover in your early 40’s and did not mention the cholesterol. Now you are in your early 50’s, things have not gone quite to plan, and you have had a heart attack.

Because the cholesterol was in your history and the insurance company did not get the chance to review this with your application, they may decline your claim because they were not aware of it.

This might sound tough especially when faced with the fact if it had been disclosed at the point of application it may not have change the terms of your policy. It is the related aspect after 20 years that causes you the issues.

I have recently had a client who requested they work through the application themselves. May be because they wanted to take their time, maybe they just did not want to talk about their medical conditions directly with me.

Either way it has resulted in more questions from the insurance company for me to ask. These have been of a probing nature about sensitive issues and there has been a bit of back and forwards too. This can get a little frustrating as it sounds like the insurer is being pedantic. If we had worked through the application together this could have been avoided, by tackling it all in one go with out the frustration factor.

If you are buying your life insurance directly, online or over the phone, you may have a disclosure issue, you will not know about until you have a claim. At that point, it is too late.

Not to mention do you have the right sort of cover at the right levels? Is the policy you have bought the most suitable for you?

What you can do about it

One of the many things I do as an adviser for you my client, is review the market for the right policy(s), we discuss the right amount of cover and then work through the application to get the right disclosure. This is all so you get your claim paid at claim time if the worst does happen.

I know it sounds complicated, it is. Anything or anyone who says they can make insurance easy is possibly not getting it right for you.

Willowgrove Consulting is about putting you on the right path for your risk management, give us a go by getting in touch

Terms & Conditions

Subscribe

My comments